Sip Eis Contribution Table 2019 Pdf

Employment insurance system act 800 eis centre.

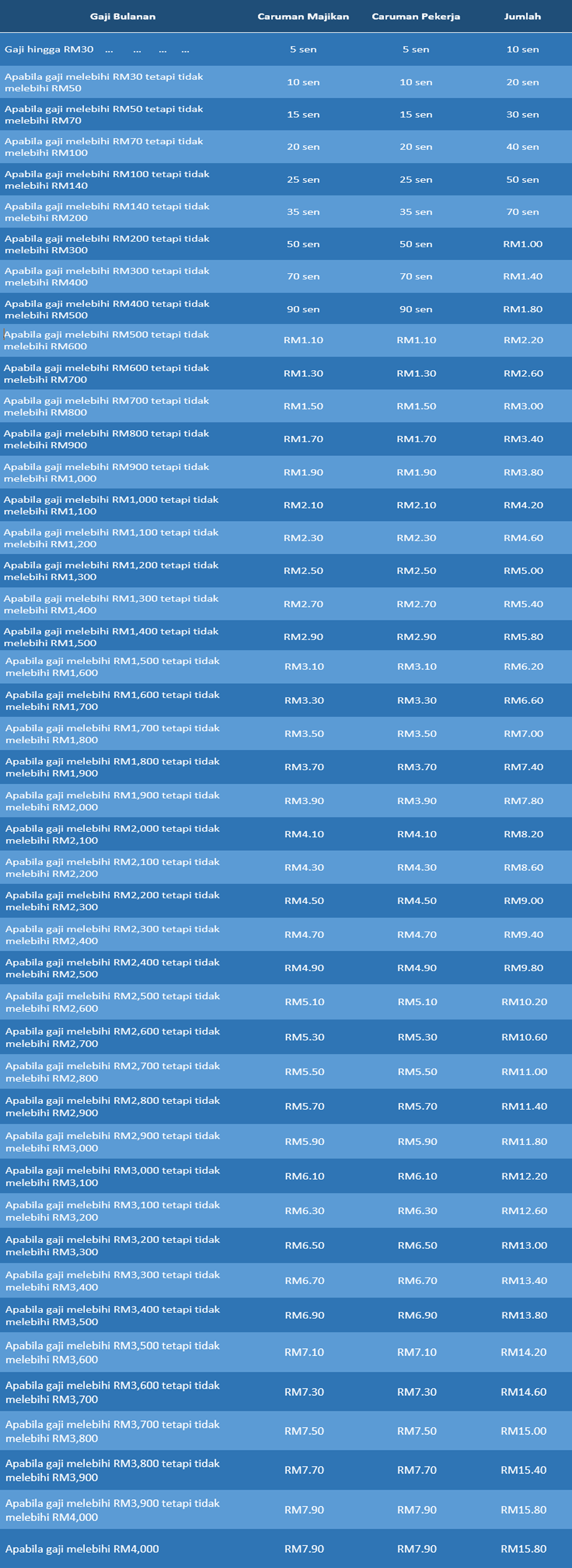

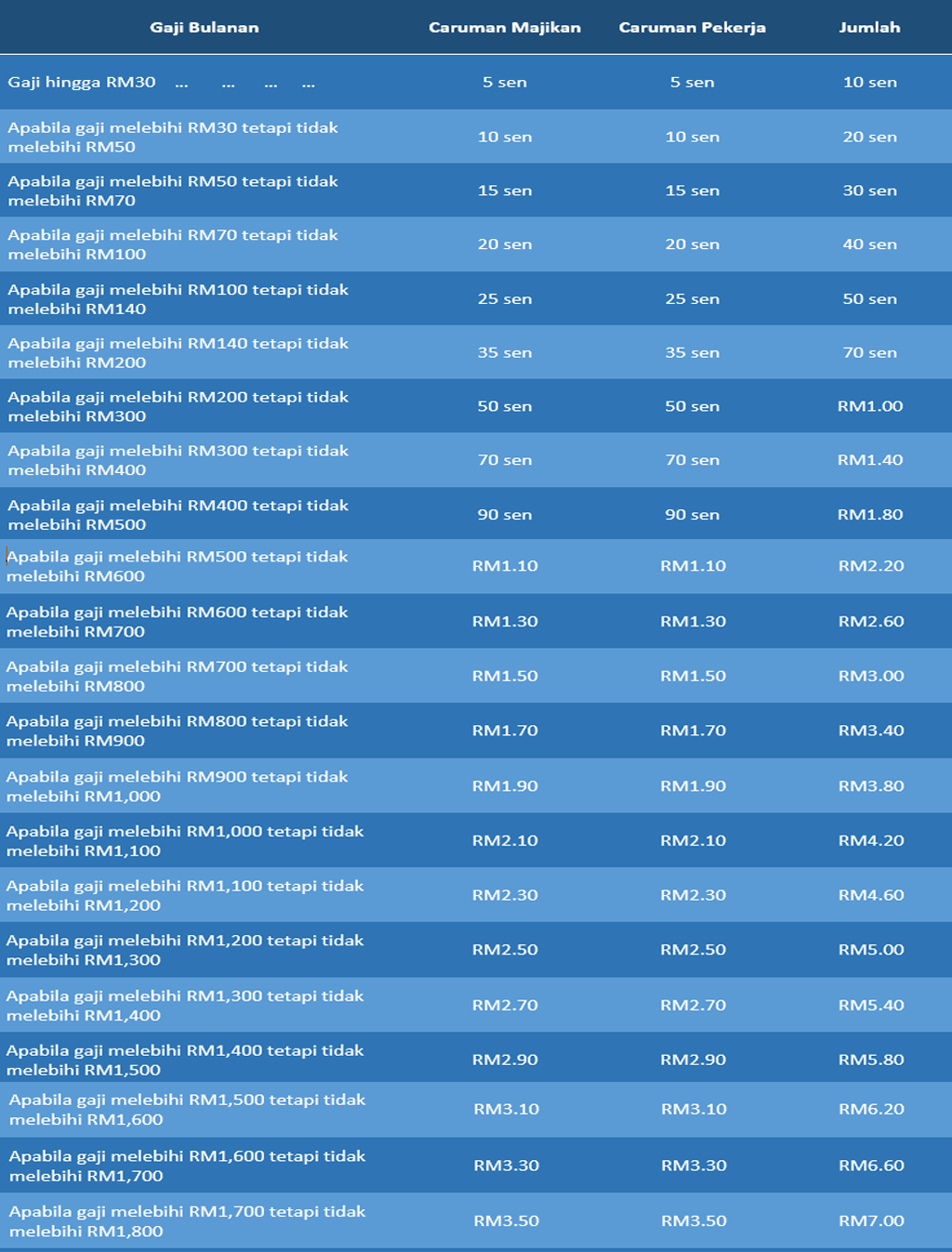

Sip eis contribution table 2019 pdf. Refer to eis ratio table since the total is 4100 then below is the eis amount deducted. Kadar caruman dan faedah emp 7. A download lampiran 1 form.

Kajian ilo tabung bantuan kehilangan pekerjaan tbkp 2011 kerajaan. Insights 3 pwc for new expatriate employees commencing their malaysian assignments in 2019 employers would have a shorter window between the contribution deadline and any registration actions as this can only commence upon the issuance of a valid work permit. The contribution rate is based on section 18 and schedule 2 of the employment insurance system act 2017.

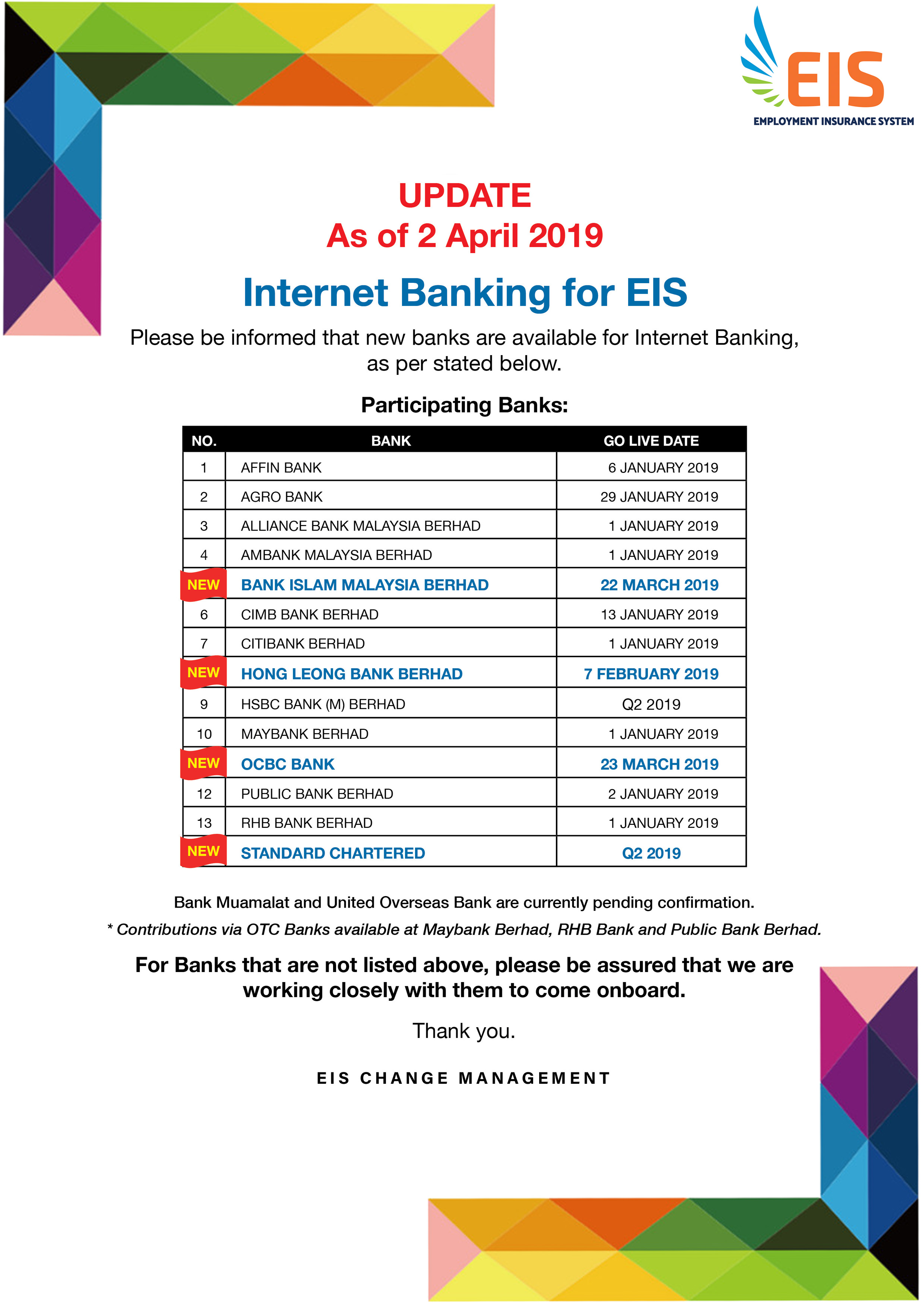

Ss contribution 1 00 130 1 340 c 360 01 560 oc 520 0c total 450 830 800 880 960 ee 00 00 total 580 00 5 150 249 149. 6 7 2019 5 05 11 pm. As the sip eis will be applicable start from the january wages onward.

Kaedah penyerahan maklumat pembayaran caruman 5. For example if the work permit is issued on january 20 2019 the employee would. The contribution of the non working spouse shall be based on fifty percent 50 of the monthly salary credit msc of his her working spouse.

Employees social security act 1969 act 4 employment injury scheme. Faedah kewangan sip 6. Self employment social security act 2017 act 789 self employment social security scheme.

Once entry is saved now you may print the payslip which will show the eis deduction. Sistem insurans pekerjaan sip taklimat awal pelaksanaan sip peringkat kebangsaan 6 disember 2017. Epf contribution third schedule.

All employers in the private sector whose employees are covered under the act are required to pay contributions on behalf of their employees. Note the contribute eis flag for existing employee is automatically ticked follow the contribute socso flag. Pendaftaran majikan dan pekerja 4.

Sip eis table. The contribution rate for employment insurance system eis is 0 2 for the employer and 0 2 for employee based on the employee s monthly salary. 0 2 will be paid by the employer while 0 2 will be deducted from the employee s monthly salary.

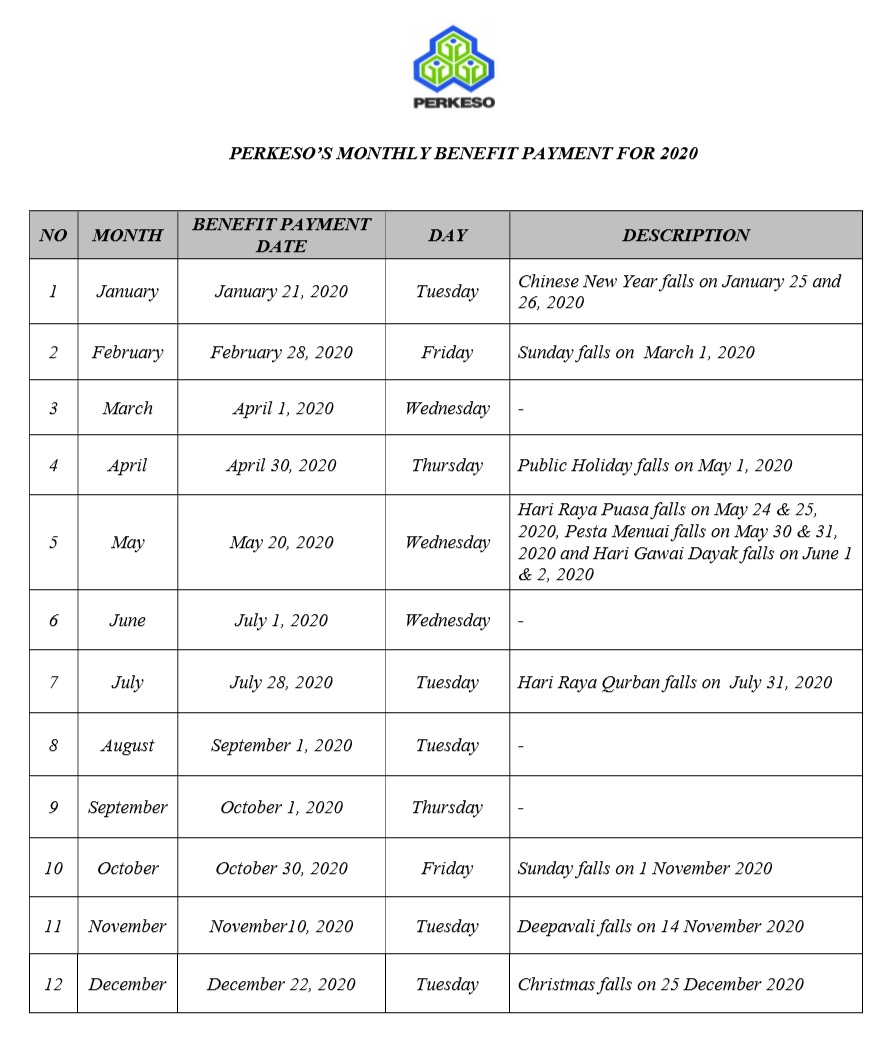

We are now sharing the way of making the contribution of sip eis. Social security appellate board. New sss contribution table 2019 for employed self employed voluntary and non working spouse.

The below explaination is extracted from the official website of sip eis. Eis information at payslip. Epf contributions tax relief up to rm4 000 this is already taken into consideration by the salary calculator life insurance premiums and takaful relief up to rm3 000.

Reka bentuk sip 3. The minimum monthly salary credit msc for regular employed self employed voluntary member and non working spouse is two thousand pesos php 2 000. Ways for sip eis contribution.

Examples of allowable deduction are. First contribution deadline on february 15 2019. Employment injury scheme for foreign worker.

Contributions to the employment insurance system eis socso table 2019 are set at 0 4 of the employee s assumed monthly salary.