Study Loan In Malaysia

Now that we know the basics of taking a loan let s move on to the numerous types of study loans available in malaysia study loans are usually funded by government bodies financial institutions such as banks orprivate corporations and organisations.

Study loan in malaysia. With the increasing cost of education planning ahead is essential to finance your education. Borrower is a malaysian resident with minimum monthly income of rm7 500. Typically a study loan covers a student s tuition fees cost of books and living expenses.

Borrower is aged between 21 and 60 years old both years inclusive. Ecm libra foundation s study loan is for underprivileged malaysians who have been offered to study at mqa approved programmes at a local private or public university or college. This loan is meant to benefit needy students who have excellent academic and co curricular records and those who have successfully undergone the selection interview process with their guarantor.

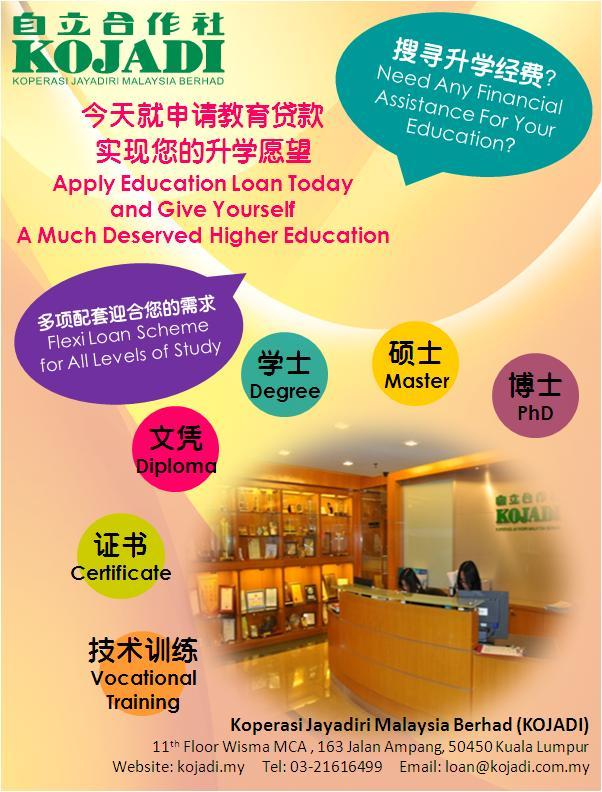

Applicable for undergraduate and postgraduate programmes. Mied offers a maximum of rm50 000 study loans to recognized universities in the public higher education institutions ipta private higher education institutions ipts and overseas or foreign universities recognized by jabatan perkhidmatan awam jpa. Presently kojadi has a total 13 loan schemes under its loan programme to cater for a wide spectrum of education courses ranging from vocational and technical to undergraduate and postgraduate.

Secure extra funding for your child s academic future without compromising on your wealth. Loans are also offered by some universities and colleges but usually in partnership with a bank. In order to apply for amma foundation loan the student has to meet the following criteria.

Bank negara malaysia offers scholarship programmes for malaysian students who wish to study at local or foreign universities. Types of financial aid. The amma foundation offers study loans to needy malaysians to pursue their studies at approved heis in malaysia.

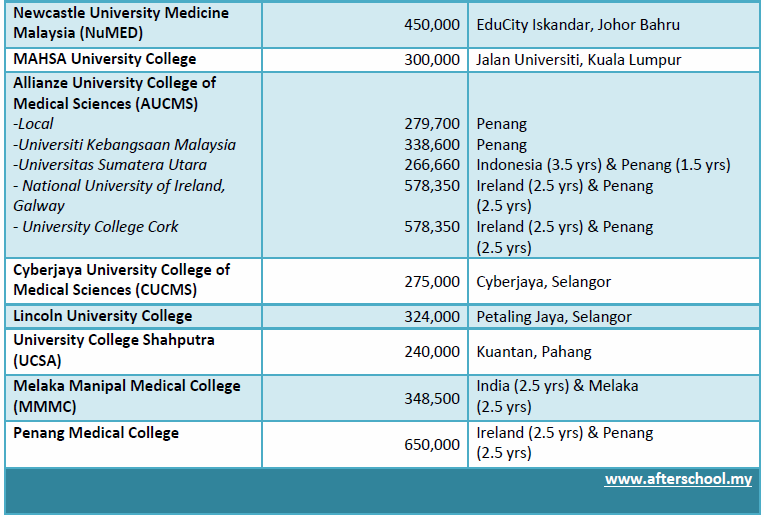

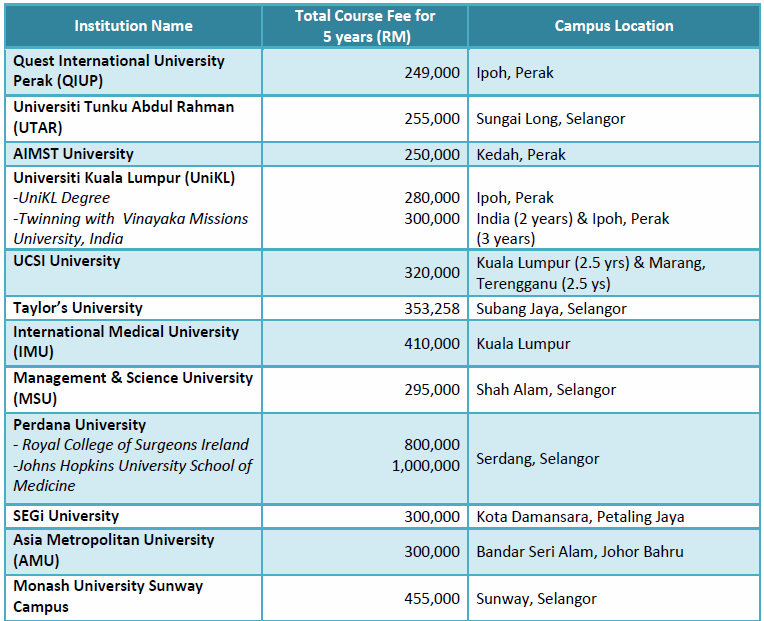

The loan amount varies according to the courses. Koperasi jayadiri malaysia berhad or kojadi was established in 1981 where its objective is to extend an effective student loan facility to enable students in need to pursue higher education and to shape students into well trained manpower to meet the demand for skilled human resources in the country. Node content display type children ct title 0 let us call you.

Higher education is one of the most important investments you will make in your lifetime. And the candidate must pass all examinations and maintain a cgpa of at least 2 75 and above each year to retain the loan. There are three scheme available.

Today mied is one of the most trusted provider of study loans to the members of malaysian indian community. In malaysia the sponsors of financial aid come from various categories. These include scholarships and loans offered by the government non governmental organisations the private sector government linked companies and trade associations.

Education loan financing i. The carlsberg hua zong education fund cef study loan is open to all malaysian citizens who are enrolled in local or foreign institutions of higher learning hold certificates in uec spm or stpm intel penang design center.