Winding Up Procedure Malaysia

A mvl is a winding up process to be initiated by the shareholders.

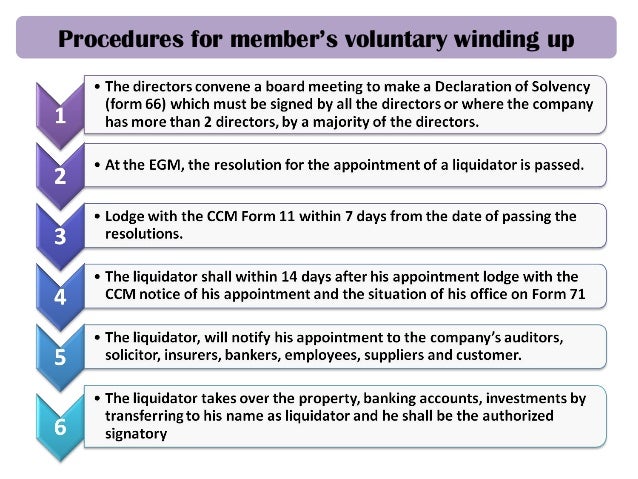

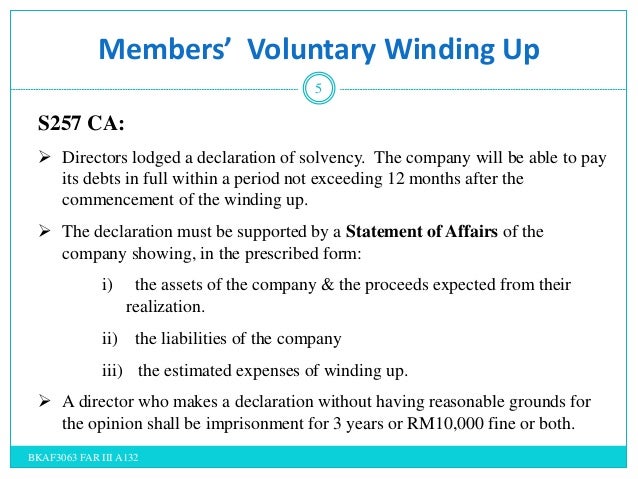

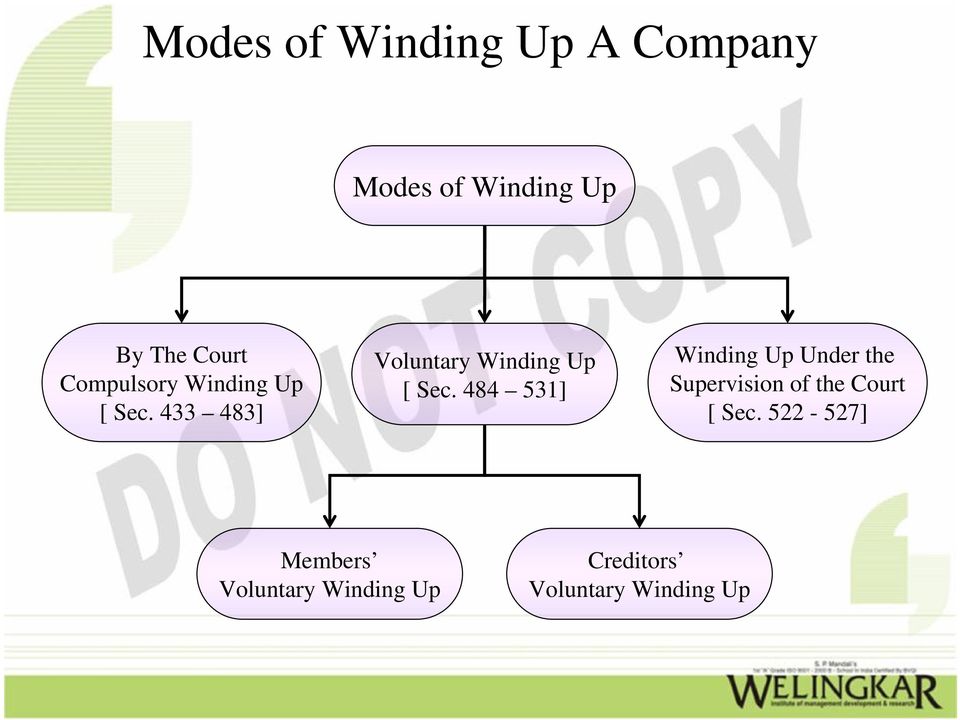

Winding up procedure malaysia. The directors will need to execute a declaration of solvency at the board of directors meeting and lodge the same with the ssm. This method is known as members voluntary winding up or members voluntary liquidation. There are two types of voluntary winding up.

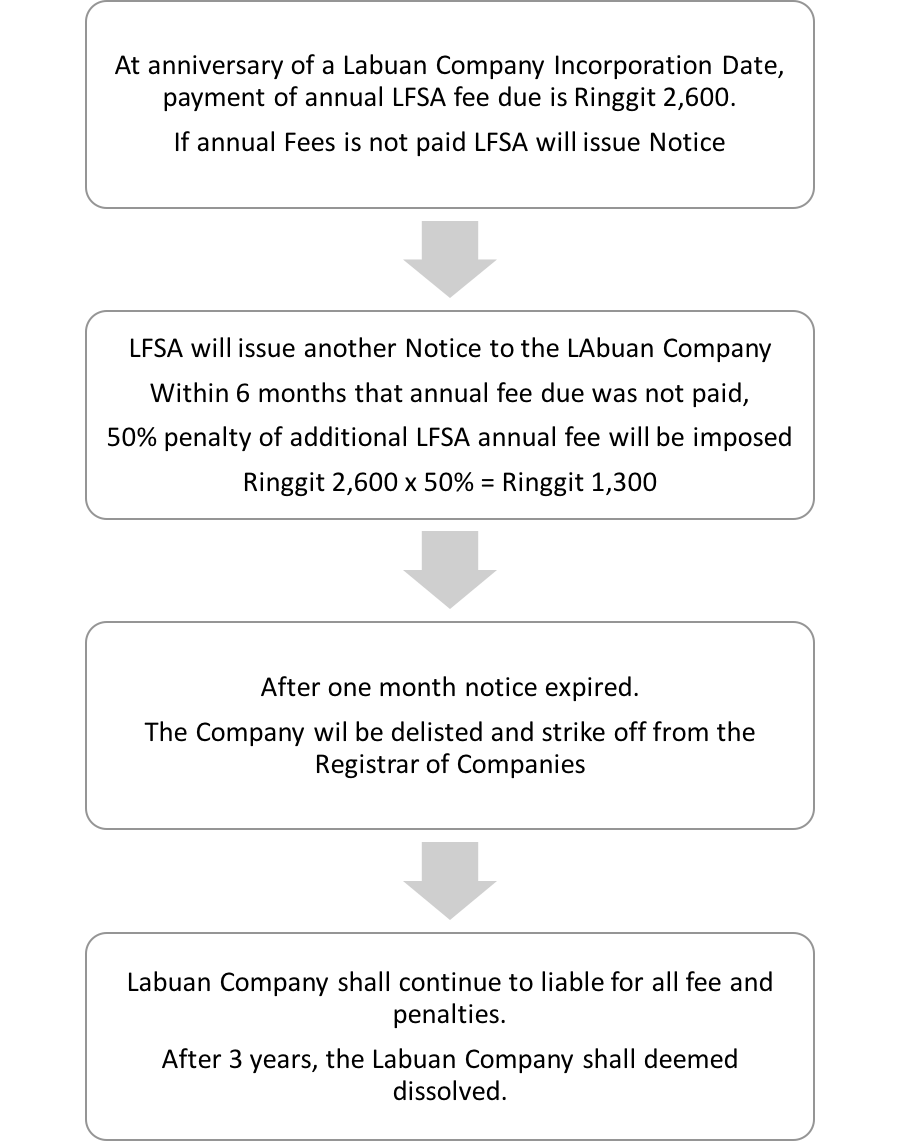

Winding up members liquidation while winding up of a company can easily cost more than rm10 000 the easier way and cost effective way to close down a company is by way of strike off. Learn about the different types of winding up in malaysia and the general procedures involved in each type of winding up. That is a overall snapshot of the winding up regime in malaysia.

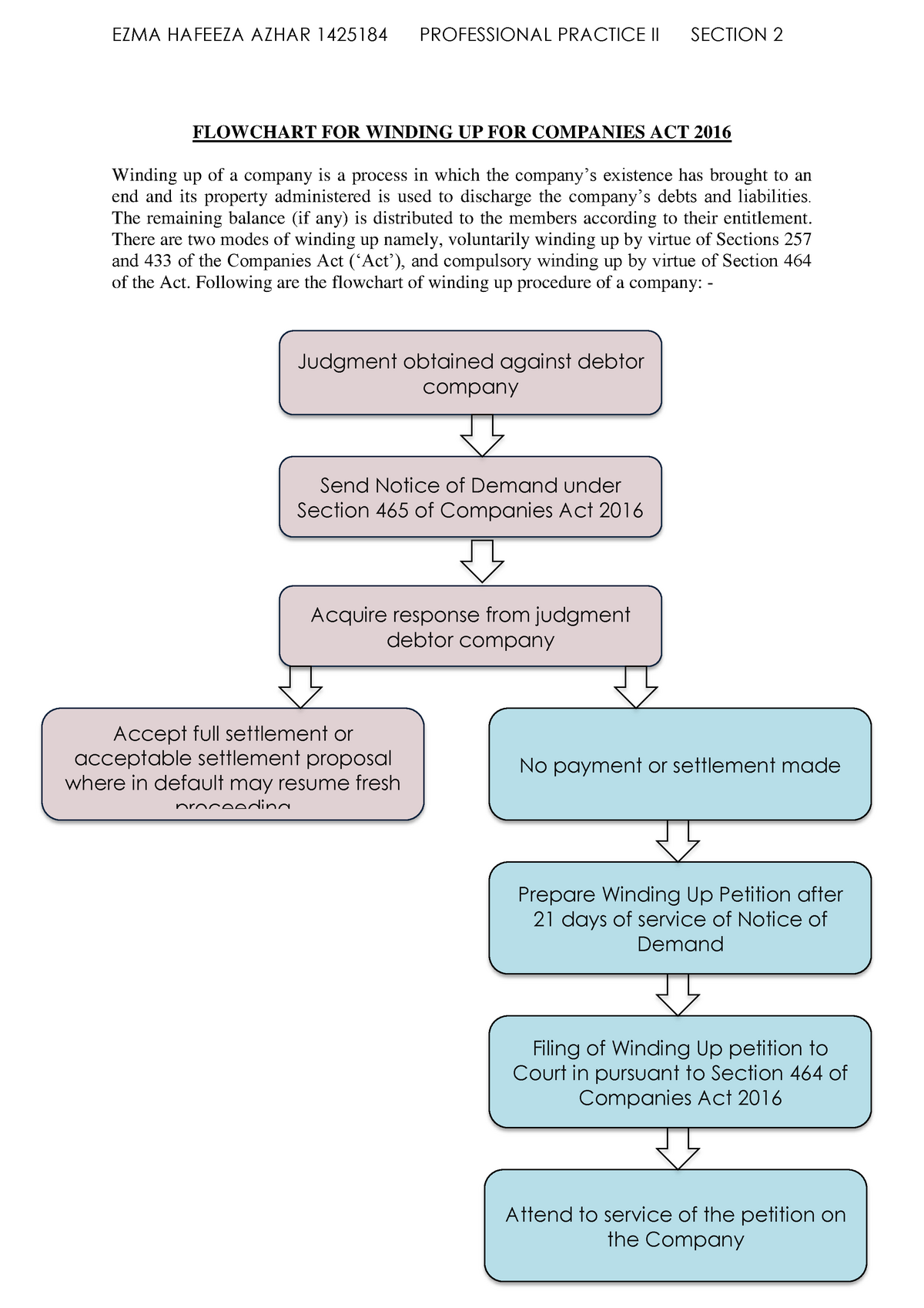

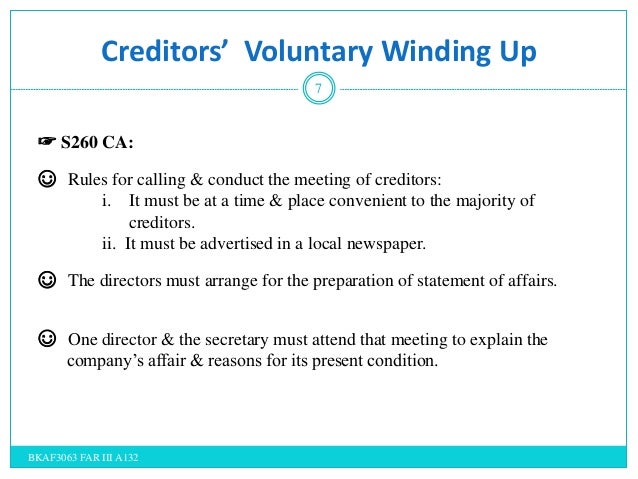

A creditor who is owed more than rm500 can send out a demand letter to the company to pay within 21 days. Rule 30 provides that the affidavit in opposition to the petition shall be filed and served at least 7 days before the hearing of the petition. The winding up activity includes selling all assets paying off creditors and distributing the remaining assets to partners or shareholders.

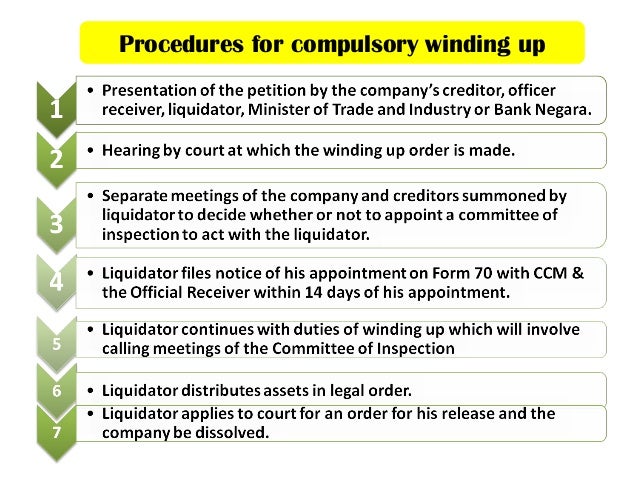

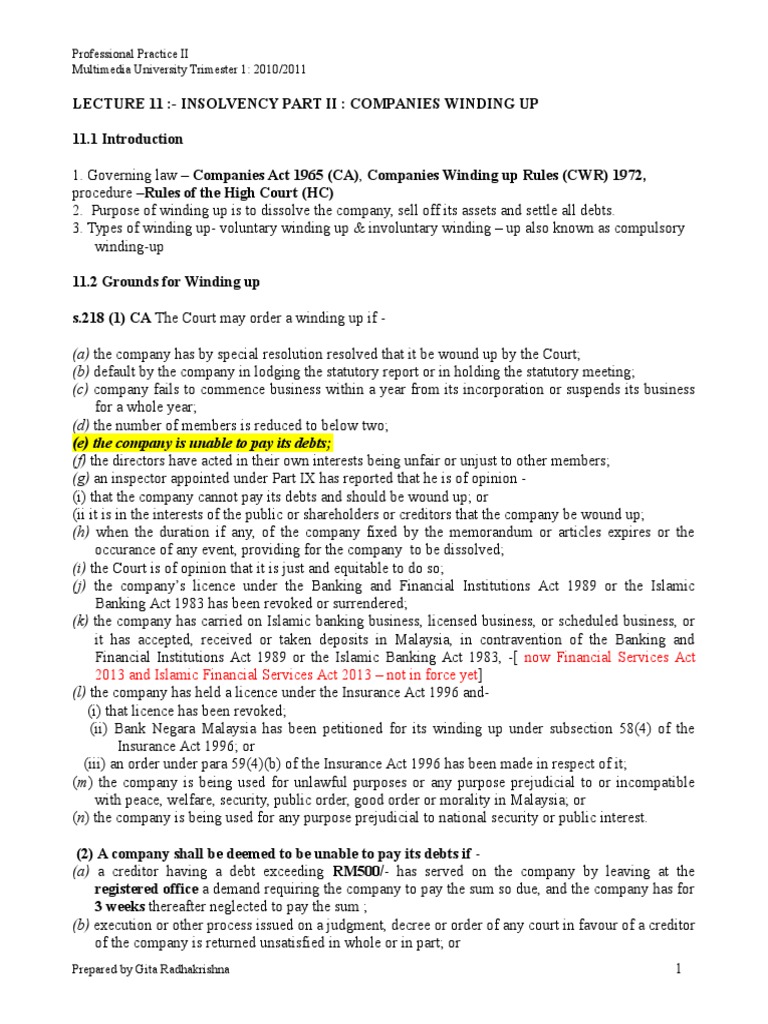

This is known as a compulsory winding up. During the process the assets of a company are liquidated meaning they are likely sold off for money and distributed to the company s creditors. Winding up is a process in which the existence of a company is brought to an end where assets of a company are collected and realised.

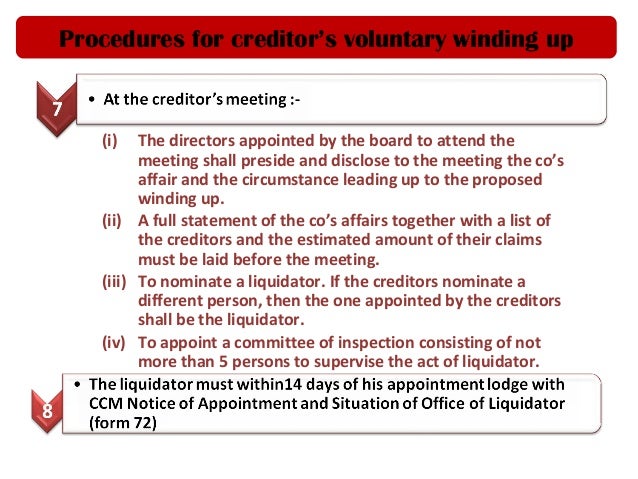

Thereafter the shareholders will appoint a liquidator to wind up the company s affairs and to file the necessary notifications required under the companies act with ssm and official receiver. Shareholders would usually receive part of the company s assets if at liquidation the value of the company s assets exceed the liabilities of the company. In the malaysian context it is very common to come across the winding up of a company through the court process.

In malaysia the winding up process is guided by the companies act. Winding up is a term used to describe the process of closing down or dissolving a company. In winding up proceedings the companies winding up rules 1972 provide for strict timelines for the filing of the affidavits.

The proceeds collected are used to discharge the company s debts and liabilities and the remaining balance if any will be is distributed amongst the contributories according to their entitlement. In order to close a company in malaysia there are two ways to do so. I highlight the most common example where a company is unable to pay its debts.

Members voluntary winding up foreword 1. It should be read in conjunction with the macpa s code of professional conduct and. One type takes place if the company is solvent but the shareholders agree to wind up the company and distribute the assets to the owners.

The liquidator will also have to arrange for publications regarding the appointment of liquidator and. The winding up of a company is the process in which the company is brought to an end.